Do you want to contribute by writing guest posts on this blog?

Please contact us and send us a resume of previous articles that you have written.

Your Answer For Raising Your Credit Score

Are you tired of being limited by a low credit score? Do you want to unlock the doors to financial opportunities that were previously unavailable to you? Well, look no further! In this comprehensive guide, we will provide you with the ultimate answer for raising your credit score and improving your financial health.

The Importance of a Good Credit Score

Before diving into the solution, it's essential to understand why having a good credit score is so crucial. Your credit score is a numerical representation of your creditworthiness and financial responsibility. Lenders, landlords, and even potential employers use this score to assess your trustworthiness and reliability.

A high credit score opens up doors to attractive loan offers, lower interest rates, better rental options, and even potential employment opportunities. On the other hand, a low credit score can lead to loan rejections, higher interest rates, limited housing options, and even difficulty in securing a job.

4.1 out of 5

| Language | : | English |

| Paperback | : | 90 pages |

| Item Weight | : | 6.7 ounces |

| Dimensions | : | 6 x 0.21 x 9 inches |

| File size | : | 3737 KB |

| Text-to-Speech | : | Enabled |

| Screen Reader | : | Supported |

| Enhanced typesetting | : | Enabled |

| Word Wise | : | Enabled |

| Print length | : | 288 pages |

Understanding Credit Score Factors

Now that we comprehend the importance of a good credit score let's delve into the factors that can affect your score:

- Payment History: This is the most significant factor, accounting for about 35% of your credit score. Consistently making timely payments on your debts can greatly boost your score.

- Utilization Ratio: Your credit utilization ratio, which is the amount of credit you have used compared to your available credit limit, significantly impacts your credit score. Aim to keep this ratio below 30%.

- Credit Age: The length of your credit history matters. The longer your credit accounts have been open, the more it reflects positively on your credit score.

- Diversity of Credit: Maintaining a healthy mix of credit types, such as credit cards, mortgages, and loans, is beneficial for your score.

- Credit Inquiries: Each time you apply for credit, a hard inquiry is recorded on your credit report. Numerous inquiries within a short period can lower your score temporarily.

The Ultimate Solution for Raising Your Credit Score

Now, you must be eagerly waiting for the highly effective solution to raise your credit score. Here is the answer you've been waiting for:

Developing Healthy Credit Habits

While it may sound simple, developing healthy credit habits is the key to improving your credit score in the long run. Here are some steps you can take:

1. Pay Your Bills On Time, Every Time

As discussed earlier, payment history contributes the most significant chunk to your credit score. Make it a priority to pay all your bills, loans, and credit card statements on time to avoid negative impacts on your score.

2. Reduce Credit Card Balances

To keep your utilization ratio in check, focus on reducing your credit card balances. Aim to keep them below 30% of your total available credit limit. Pay more than the minimum payment each month to tackle your outstanding debts more effectively.

3. Limit New Credit Applications

As every hard inquiry impacts your credit score, avoid applying for multiple credit cards or loans within a short timeframe. Instead, focus on enhancing and maintaining your existing credit accounts.

4. Keep Old Credit Accounts Open

Remember, credit history length matters. Even if you have paid off a credit card, consider keeping it open as it contributes to the overall age of your accounts. Additionally, it increases the available credit limit, which indirectly lowers your utilization ratio.

5. Regularly Monitor Your Credit Reports

Closely monitoring your credit reports helps you catch any errors or fraudulent activities that can negatively impact your score. Every year, you have the right to receive a free copy of your credit report from the major credit bureaus. Take advantage of this to ensure the accuracy of your credit information.

Patience and Persistence Lead to Success

Remember that improving your credit score is not an overnight process. It requires consistent effort, responsible financial habits, and patience. Stick to the healthy credit habits outlined above, and with time, you will see positive changes in your credit score.

By raising your credit score, you will gain access to better financial offers, improved housing options, and increased job prospects. So, take control of your financial future and start building a strong credit profile today!

4.1 out of 5

| Language | : | English |

| Paperback | : | 90 pages |

| Item Weight | : | 6.7 ounces |

| Dimensions | : | 6 x 0.21 x 9 inches |

| File size | : | 3737 KB |

| Text-to-Speech | : | Enabled |

| Screen Reader | : | Supported |

| Enhanced typesetting | : | Enabled |

| Word Wise | : | Enabled |

| Print length | : | 288 pages |

Anyone with credit problems can solve them and repair any damage if they have the right tools and take the right actions. The Credit Repair Answer Book explains that dealing with credit problems is a combination of understanding what credit is and is not; understanding what one's credit rights are; understanding to what extent a creditor can go to collect a debt; and, understanding what to do if an invalid or illegal action is taken by creditors in the collection process.

A section on the most frequently asked questions with extensive answers helps the reader quickly grasp the value of good credit and know how to ensure that credit errors or potential credit problems do not affect your credit rating in the long term.

The Credit Repair Answer Book can get anyone back on the right track and turn their financial situation around.

Reed Mitchell

Reed MitchellTango For Chromatic Harmonica Dave Brown: Unleashing the...

The hauntingly beautiful sound of the...

Patrick Rothfuss

Patrick RothfussHow To Tie The 20 Knots You Need To Know

Knot-tying is an essential...

Vince Hayes

Vince HayesThe Politics Experiences and Legacies of War in the US,...

War has always had a profound impact...

Leo Mitchell

Leo MitchellThe Psychedelic History Of Mormonism Magic And Drugs

Throughout history, the connections between...

Michael Simmons

Michael SimmonsThe Practical Japan Travel Guide: All You Need To Know...

Japan, known for its unique...

Deion Simmons

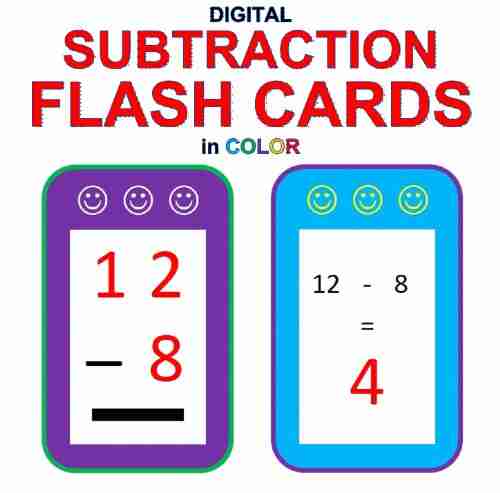

Deion SimmonsDigital Subtraction Flash Cards in Color: Shuffled Twice...

Mathematics is an essential...

Emanuel Bell

Emanuel BellUnveiling the Enigma: Explore the Fascinating World of...

Hello, dear readers! Today, we have a...

Darren Nelson

Darren NelsonHow To Handle Your Parents - A Comprehensive Guide

Are you having trouble dealing with your...

Jimmy Butler

Jimmy ButlerThe Loopy Coop Hens Letting Go: A Tale of Friendship and...

Once upon a time, in a peaceful...

Charles Dickens

Charles DickensGreen Are My Mountains: An Autobiography That Will Leave...

Are you ready to embark on an...

Drew Bell

Drew BellRogue Trainer Secrets To Transforming The Body...

In this fast-paced...

Light bulbAdvertise smarter! Our strategic ad space ensures maximum exposure. Reserve your spot today!

Junichiro TanizakiThe Ultimate Guide to Mastering Project Management - Project Management Step...

Junichiro TanizakiThe Ultimate Guide to Mastering Project Management - Project Management Step...

Percy Bysshe ShelleyStatic Line Parachuting Techniques And Training Field Manual FM 21-220 FM 57...

Percy Bysshe ShelleyStatic Line Parachuting Techniques And Training Field Manual FM 21-220 FM 57... Corbin PowellFollow ·5k

Corbin PowellFollow ·5k Michael ChabonFollow ·7.4k

Michael ChabonFollow ·7.4k Caleb CarterFollow ·13.5k

Caleb CarterFollow ·13.5k Junot DíazFollow ·14k

Junot DíazFollow ·14k Robert Louis StevensonFollow ·6.7k

Robert Louis StevensonFollow ·6.7k Orson Scott CardFollow ·2.7k

Orson Scott CardFollow ·2.7k George R.R. MartinFollow ·3.5k

George R.R. MartinFollow ·3.5k Cormac McCarthyFollow ·5.7k

Cormac McCarthyFollow ·5.7k