Do you want to contribute by writing guest posts on this blog?

Please contact us and send us a resume of previous articles that you have written.

Raising Venture Capital For The Serious Entrepreneur

Every serious entrepreneur dreams of taking their business to the next level. They envision their ideas turning into successful ventures that disrupt industries and change the world. However, to accomplish such ambitious goals, entrepreneurs often need significant financial resources that go beyond their personal savings or bootstrapping capabilities.

The Importance of Venture Capital

Venture capital plays a vital role in fueling the growth and success of startups and high-growth companies. It provides entrepreneurs with the necessary funds to develop their ideas, commercialize their products, scale their operations, and expand their market reach. Furthermore, venture capitalists bring more than just financial support; they provide valuable expertise, mentorship, and networking opportunities that can dramatically increase the chances of success.

Raising venture capital is a highly competitive and rigorous process. It requires entrepreneurs to present their business plans, market analysis, competitive advantage, and growth projections to potential investors. Demonstrating a scalable business model and a clear path to profitability is essential. Investors need to be convinced that their investment will yield substantial returns while mitigating risks.

4.4 out of 5

| Language | : | English |

| File size | : | 1939 KB |

| Text-to-Speech | : | Enabled |

| Screen Reader | : | Supported |

| Word Wise | : | Enabled |

| Print length | : | 311 pages |

Preparing Your Business for Venture Capital

Raising venture capital requires meticulous preparation. Before approaching investors, it is crucial to have a solid foundation in place. This includes:

- A Compelling Pitch: Craft a persuasive pitch deck that clearly communicates your business model, unique value proposition, and growth potential.

- Market Research: Gather extensive market research to demonstrate your understanding of the industry, target audience, and competitive landscape.

- Traction: Show evidence of market traction, such as a growing customer base, revenue, or partnerships, to validate the viability of your business.

- A Stellar Team: Assemble a capable and experienced team that investors can trust to execute the business plan successfully.

- A Scalable Business Model: Develop a clear strategy for scaling your operations and achieving sustainable growth.

Finding the Right Investors

Not all venture capitalists are the same, and finding the right fit for your business is crucial. Conduct thorough research to identify potential investors who have a track record in your industry and a genuine interest in supporting companies like yours. Attend industry events, connect with entrepreneurs who have successfully raised capital, and leverage your network to find warm s to investors.

Approaching investors with a tailored approach will greatly increase your chances of success. Customize your pitch to align with their investment thesis, demonstrate how your business fits into their portfolio, and highlight how their expertise can help drive your company's growth.

Key Considerations for Negotiating with Investors

When engaging in negotiations with potential investors, it is essential to keep in mind the following key considerations:

- Valuation: Determine a fair valuation for your business. Be prepared to negotiate, but also ensure that you are not giving away too much equity or control.

- Term Sheet: Carefully review and seek legal advice on the term sheet offered by investors. Pay particular attention to provisions related to control, liquidation preferences, and anti-dilution measures.

- Board Representation: Consider the implications of giving board seats to investors. While their expertise can be valuable, ensure that their interests align with the long-term vision of your company.

- Exit Strategy: Discuss potential exit strategies upfront to ensure both parties are aligned. Venture capitalists often seek an exit within a few years to generate returns, so understanding their expectations is crucial.

s

Raising venture capital is a significant milestone for any serious entrepreneur. It provides the necessary financial resources and expertise to turn dreams into reality. However, it demands meticulous preparation, a compelling pitch, and a tailored approach to find the right investors. By considering the key negotiations and carefully structuring the deal, entrepreneurs can secure the funds and mentorship needed to propel their businesses forward.

Unlocking venture capital can be the turning point in the journey of a serious entrepreneur. With the right strategic approach and a strong business foundation, the opportunities for success are limitless.

4.4 out of 5

| Language | : | English |

| File size | : | 1939 KB |

| Text-to-Speech | : | Enabled |

| Screen Reader | : | Supported |

| Word Wise | : | Enabled |

| Print length | : | 311 pages |

Get the Funding You Need From Venture Capitalists and Turn Your New Business Proposal into Reality

Authoritative and comprehensive, Raising Venture Capital for the Serious Entrepreneur is an all-in-one sourcebook for entrepreneurs seeking venture capital from investors. This expert resource contains an unsurpassed analysis of the venture capital process, together with the guidance and strategies you need to make the best possible deal_and ensure the success of your business.

Written by a leading international venture capitalist, this business-building resource explores the basics of the venture capital method, strategies for raising capital, methods of valuing the early-stage venture, and techniques for negotiating the deal.

Filled with case studies, charts, and exercises, Raising Venture Capital for the Serious Entrepreneur explains:

- How to develop a financing map

- How to determine the amount of capital to raise and what to spend it on

- How to create a winning business plan

- How to agree on a term sheet with a venture capitalist

- How to split the rewards

- How to allocate control between founders/management and investors

Reed Mitchell

Reed MitchellTango For Chromatic Harmonica Dave Brown: Unleashing the...

The hauntingly beautiful sound of the...

Patrick Rothfuss

Patrick RothfussHow To Tie The 20 Knots You Need To Know

Knot-tying is an essential...

Vince Hayes

Vince HayesThe Politics Experiences and Legacies of War in the US,...

War has always had a profound impact...

Leo Mitchell

Leo MitchellThe Psychedelic History Of Mormonism Magic And Drugs

Throughout history, the connections between...

Michael Simmons

Michael SimmonsThe Practical Japan Travel Guide: All You Need To Know...

Japan, known for its unique...

Deion Simmons

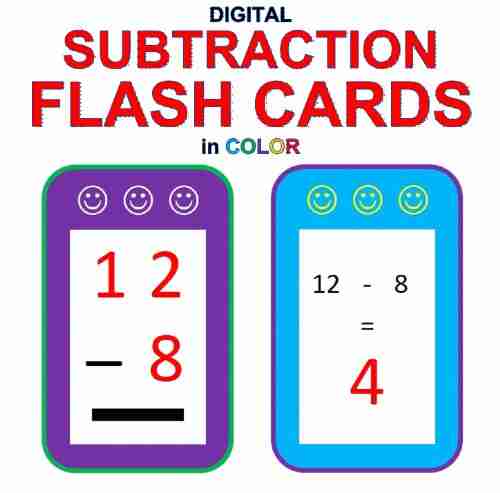

Deion SimmonsDigital Subtraction Flash Cards in Color: Shuffled Twice...

Mathematics is an essential...

Emanuel Bell

Emanuel BellUnveiling the Enigma: Explore the Fascinating World of...

Hello, dear readers! Today, we have a...

Darren Nelson

Darren NelsonHow To Handle Your Parents - A Comprehensive Guide

Are you having trouble dealing with your...

Jimmy Butler

Jimmy ButlerThe Loopy Coop Hens Letting Go: A Tale of Friendship and...

Once upon a time, in a peaceful...

Charles Dickens

Charles DickensGreen Are My Mountains: An Autobiography That Will Leave...

Are you ready to embark on an...

Drew Bell

Drew BellRogue Trainer Secrets To Transforming The Body...

In this fast-paced...

Light bulbAdvertise smarter! Our strategic ad space ensures maximum exposure. Reserve your spot today!

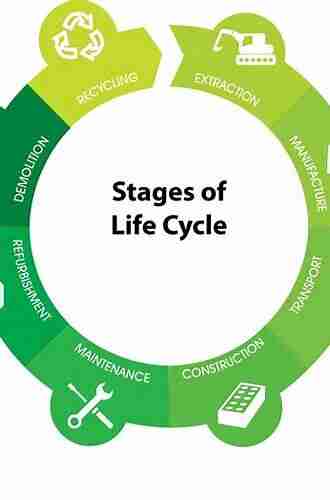

Elton HayesThe Ultimate Guide: An Environmental Life Cycle Approach To Design That Will...

Elton HayesThe Ultimate Guide: An Environmental Life Cycle Approach To Design That Will...

Javier BellThe Vanishing Of Willa Sloan: A Gripping Mystery That Will Leave You on the...

Javier BellThe Vanishing Of Willa Sloan: A Gripping Mystery That Will Leave You on the...

Patrick RothfussThe Mesmerizing Venus In Fur Play: A Captivating Journey of Power, Seduction,...

Patrick RothfussThe Mesmerizing Venus In Fur Play: A Captivating Journey of Power, Seduction,... Trevor BellFollow ·5.1k

Trevor BellFollow ·5.1k Jason ReedFollow ·11.5k

Jason ReedFollow ·11.5k Franklin BellFollow ·2.2k

Franklin BellFollow ·2.2k Isaias BlairFollow ·15.6k

Isaias BlairFollow ·15.6k Brian BellFollow ·14k

Brian BellFollow ·14k Benji PowellFollow ·5.7k

Benji PowellFollow ·5.7k Ernest J. GainesFollow ·11.2k

Ernest J. GainesFollow ·11.2k Finn CoxFollow ·13.5k

Finn CoxFollow ·13.5k