Do you want to contribute by writing guest posts on this blog?

Please contact us and send us a resume of previous articles that you have written.

The Way of the VC - Unlocking the Secrets of Successful Venture Capitalists

Are you curious about what it takes to become a successful venture capitalist and invest in groundbreaking startups? Venture capital (VC) has become an increasingly important part of the entrepreneurial ecosystem, with VCs providing essential funding and support to ambitious innovators. In this article, we will delve into the way of the VC and explore the strategies, mindset, and skills required to excel in this fast-paced and lucrative field.

The Role of Venture Capitalists

Venture capitalists are professionals who provide capital to startups or young companies with high growth potential. These firms pool money from various sources, such as wealthy individuals, pension funds, and institutional investors, and invest it into businesses in exchange for an equity stake.

VCs play a critical role in fostering innovation and economic growth. By identifying and investing in promising startups, they facilitate entrepreneurial activity and provide the capital needed to bring revolutionary ideas to life. VCs are not only sources of funding but also offer mentorship, expertise, and valuable connections to their portfolio companies, enabling them to scale and thrive.

4.9 out of 5

| Language | : | English |

| File size | : | 2147 KB |

| Text-to-Speech | : | Enabled |

| Screen Reader | : | Supported |

| Enhanced typesetting | : | Enabled |

| Word Wise | : | Enabled |

| Print length | : | 303 pages |

| Lending | : | Enabled |

| X-Ray for textbooks | : | Enabled |

The VC Mindset

Successful VCs possess a unique mindset that sets them apart from traditional investors. They are risk-takers who show a willingness to embrace uncertainty and disruption. They understand that not all investments will yield immediate returns, and they are willing to patiently nurture companies over a period of years, even in the face of initial setbacks.

VCs also possess exceptional strategic thinking and analytical skills. They need to identify trends, anticipate market shifts, and evaluate the potential of innovative business models. They are constantly researching and exploring emerging technologies, industries, and markets, staying one step ahead to identify compelling investment opportunities.

Furthermore, VCs must have a passion for entrepreneurship and an unwavering belief in the potential of startups. They are driven by the excitement of working with visionary founders, turning their ideas into reality, and shaping the future of industries. This passion fuels their ability to spot the next big thing and make smart investment decisions.

Strategies for Successful Venture Capital Investment

1. Thorough Due Diligence: Before investing in a startup, VCs conduct extensive due diligence to assess its viability and potential. This involves scrutinizing the business plan, financials, market analysis, competitive landscape, and the team's capabilities. VCs look for indications of a scalable business model, a large addressable market, and a strong management team.

2. Diversification: VCs understand that investing in startups is inherently risky, so they mitigate this risk by building a diverse portfolio of investments. They spread their investment across different industries, stages, and geographies to minimize the impact of any individual failure. This diversification strategy helps ensure that the overall portfolio delivers returns even if some investments do not succeed.

3. Value-Added Support: Successful VCs provide more than just funding - they offer invaluable support to their portfolio companies. They bring expertise, industry connections, and guidance to help the entrepreneurs overcome challenges and navigate the complex startup landscape. This hands-on support can make a significant difference in a startup's success.

4. Patience and Long-Term Perspective: Venture capital investments often require a long-term horizon. VCs understand that building successful companies takes time, and they are willing to be patient. They stay committed to their portfolio companies and provide continuous support during both good and challenging times.

Learning from the Masters

For aspiring VCs, learning from successful practitioners is crucial. Here are a few influential venture capitalists worth studying:

1. Peter Thiel: Co-founder of PayPal and early investor in Facebook, Thiel is known for his contrarian investing philosophy. His book, "Zero to One," offers unique insights into building innovative companies and identifying untapped markets.

2. Mary Meeker: A renowned internet analyst and partner at Bond Capital, Meeker's annual "Internet Trends Report" provides valuable insights into emerging trends and sectors that are ripe for disruption.

3. Ben Horowitz: Co-founder of Andreessen Horowitz, Horowitz's book "The Hard Thing About Hard Things" is essential reading for understanding the challenges faced by startups and the role of VCs in supporting them.

Venture capital is a fascinating and dynamic field that allows individuals to be at the forefront of innovation and shape the future of industries. The way of the VC requires a unique set of skills, including strategic thinking, risk-taking, and a genuine passion for entrepreneurship. By following successful venture capitalists' strategies and learning from industry pioneers, aspiring VCs can unlock the secrets to becoming masterful investors and contribute to the growth of groundbreaking startups.

4.9 out of 5

| Language | : | English |

| File size | : | 2147 KB |

| Text-to-Speech | : | Enabled |

| Screen Reader | : | Supported |

| Enhanced typesetting | : | Enabled |

| Word Wise | : | Enabled |

| Print length | : | 303 pages |

| Lending | : | Enabled |

| X-Ray for textbooks | : | Enabled |

Venture Capital funds are the fastest growing sector of the financial industry, and possibly the least understood. In this book, the author provides a primer on what some of the world's best venture capitalists have in common. How do the world's top venture capitalists consistently obtain supernormal returns? How do they add value to entrepreneurs they have backed? Why is a top venture capitalist like a skilled chef?

- How did Lip Bu Tan, when he was Chairman of Walden, manage to invest in Creative Technology, despite the CEO's aversion for VCs?

- How did Nam Ho, Founder and Managing Partner of Altos Venture, turn an by a Stanford Business School professor into a venture capital firm managing a quarter billion dollars of capital?

- How does Bing Gordon, Partner at Kleiner Perkins Caufield & Byers and author of the business plan that resulted in KPCB's investment in Electronic Arts, time exits properly?

- Why did Soo Boon Koh, Managing Director of IGlobe Ventures, back a GPS company which was filing for Chapter 11, in the post 9-11 market?

The Way of the VC: Having Top Venture Capitalists on Your Board is essential reading for venture capital practitioners, including partners, principals, analysts, consultants and limited partners--both institutional and private. It is also useful to students of finance who want a better understanding of what goes on in the venture capital world.

Reed Mitchell

Reed MitchellTango For Chromatic Harmonica Dave Brown: Unleashing the...

The hauntingly beautiful sound of the...

Patrick Rothfuss

Patrick RothfussHow To Tie The 20 Knots You Need To Know

Knot-tying is an essential...

Vince Hayes

Vince HayesThe Politics Experiences and Legacies of War in the US,...

War has always had a profound impact...

Leo Mitchell

Leo MitchellThe Psychedelic History Of Mormonism Magic And Drugs

Throughout history, the connections between...

Michael Simmons

Michael SimmonsThe Practical Japan Travel Guide: All You Need To Know...

Japan, known for its unique...

Deion Simmons

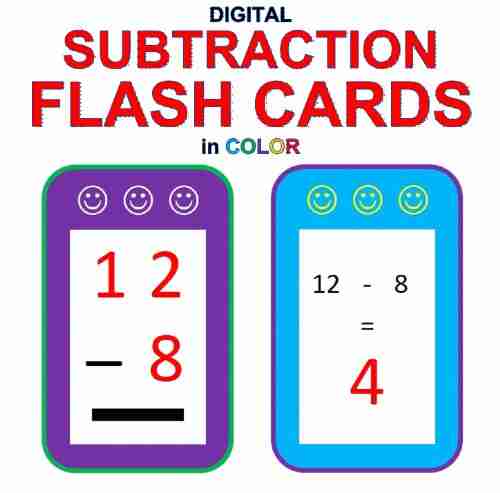

Deion SimmonsDigital Subtraction Flash Cards in Color: Shuffled Twice...

Mathematics is an essential...

Emanuel Bell

Emanuel BellUnveiling the Enigma: Explore the Fascinating World of...

Hello, dear readers! Today, we have a...

Darren Nelson

Darren NelsonHow To Handle Your Parents - A Comprehensive Guide

Are you having trouble dealing with your...

Jimmy Butler

Jimmy ButlerThe Loopy Coop Hens Letting Go: A Tale of Friendship and...

Once upon a time, in a peaceful...

Charles Dickens

Charles DickensGreen Are My Mountains: An Autobiography That Will Leave...

Are you ready to embark on an...

Drew Bell

Drew BellRogue Trainer Secrets To Transforming The Body...

In this fast-paced...

Light bulbAdvertise smarter! Our strategic ad space ensures maximum exposure. Reserve your spot today!

Andrew BellDiscover the Vibrant Culture and Charming Personalities: Sketches of Burmese...

Andrew BellDiscover the Vibrant Culture and Charming Personalities: Sketches of Burmese... Elliott CarterFollow ·7.4k

Elliott CarterFollow ·7.4k T.S. EliotFollow ·17.2k

T.S. EliotFollow ·17.2k Mark MitchellFollow ·7.7k

Mark MitchellFollow ·7.7k Gus HayesFollow ·10.3k

Gus HayesFollow ·10.3k Kenneth ParkerFollow ·10.8k

Kenneth ParkerFollow ·10.8k Boris PasternakFollow ·10.7k

Boris PasternakFollow ·10.7k Jessie CoxFollow ·7.7k

Jessie CoxFollow ·7.7k Bryson HayesFollow ·18.6k

Bryson HayesFollow ·18.6k