Do you want to contribute by writing guest posts on this blog?

Please contact us and send us a resume of previous articles that you have written.

Choosing Your Exit Path And Maximizing Value When You Get There

When it comes to building a successful business, one must always consider the exit strategy. Every entrepreneur dreams of reaching the point where they can sell their company for a significant sum or pass it on to the next generation. However, choosing the right exit path and maximizing the value when you get there requires careful planning and execution. In this article, we will explore various exit options and discuss strategies to maximize the value of your business.

The Importance of Planning Ahead

Before we dive into the different exit paths, it is crucial to emphasize the importance of planning ahead. Many entrepreneurs make the mistake of waiting until they are ready to exit before considering their options. By that time, it may be too late to optimize the value of the business and choose the best path for their desired outcome.

Planning ahead allows the business owner to align the company's financials, operations, and growth trajectory with the desired exit strategy. It provides ample time to make necessary adjustments and improvements to attract potential buyers or investors.

5 out of 5

| Language | : | English |

| File size | : | 2180 KB |

| Text-to-Speech | : | Enabled |

| Screen Reader | : | Supported |

| Enhanced typesetting | : | Enabled |

| Word Wise | : | Enabled |

| Print length | : | 91 pages |

| Lending | : | Enabled |

Exit Path Options

There are several exit paths available to entrepreneurs, each with its own advantages and considerations. Let's explore some of the most common options:

1. Sale to a Strategic Buyer

A strategic buyer is a company that sees value in acquiring your business for a specific strategic reason. This could be to expand their market share, access your technology, or benefit from synergies between the two companies. Selling to a strategic buyer often yields a higher valuation as they recognize the strategic advantages your business brings to theirs.

When pursuing this option, it is crucial to identify potential strategic buyers early on and establish relationships. Understanding their goals and aligning your business accordingly will make it more attractive to them when the time comes.

2. Management Buyout

In some cases, the most desirable exit path may be to sell the business to the current management team. Management buyouts offer continuity for both employees and customers, as the existing management team is already familiar with the company's operations and direction.

For a successful management buyout, it is essential to have a capable and motivated management team in place. This ensures a smooth transition and increases the chances of maximizing the value of the business.

3. Initial Public Offering (IPO)

An IPO is the process of offering shares of a private corporation to the public, effectively taking the company public. Going public can significantly increase the value of the business and provide access to capital markets for further growth and expansion.

However, an IPO requires extensive preparation, including meeting regulatory requirements, financial audits, and investor roadshows. It is a complex and time-consuming process that requires careful consideration and planning.

4. Merger or Acquisition

A merger or acquisition involves combining two companies to create a larger, more competitive entity. This can be an attractive exit strategy for entrepreneurs looking to pool resources, expand their market reach, or strengthen their competitive position.

When considering a merger or acquisition, it is important to evaluate potential synergies, cultural fit, and the overall strategic alignment between the two companies. A well-executed merger or acquisition can create significant value for both parties involved.

Maximizing Value During Exit

Regardless of the chosen exit path, maximizing the value of your business requires careful planning and execution. Here are some strategies to consider:

1. Enhance Financial Performance

Potential buyers and investors place a high value on businesses with strong financial performance. Enhance your financials by optimizing costs, improving profitability, and diversifying revenue streams. Demonstrating consistent growth and profitability increases the attractiveness of your business.

2. Build a Strong Management Team

A capable and motivated management team is vital for the long-term success of any business. Invest in developing and retaining top talent within your organization. A strong management team not only ensures a smooth transition during the exit process but also demonstrates the strength and stability of your business to potential buyers.

3. Leverage Intellectual Property

If your business holds valuable intellectual property, such as patents or proprietary technology, leverage it to increase the value of your company. Intellectual property can be a strong differentiator and provide a competitive advantage that attracts buyers or investors.

4. Diversify Customer Base

Dependence on a single customer or a few key clients can be a red flag for potential buyers. Diversify your customer base to reduce risk and increase the stability and attractiveness of your business. Acquiring new customers and expanding into new markets demonstrates growth potential and broadens the appeal of your company.

5. Develop a Scalable Business Model

Creating a scalable business model allows for rapid growth and potential expansion opportunities. Buyers and investors are attracted to businesses with strong growth potential and the ability to scale operations efficiently. Evaluate your existing business model and make necessary adjustments to optimize for scalability.

Choosing your exit path and maximizing the value when you get there requires careful planning and execution. By planning ahead and considering different exit options, you increase the chances of achieving your desired outcome. Throughout the exit process, focus on enhancing financial performance, building a strong management team, leveraging intellectual property, diversifying your customer base, and developing a scalable business model. By following these strategies, you can position your business for a successful and lucrative exit.

5 out of 5

| Language | : | English |

| File size | : | 2180 KB |

| Text-to-Speech | : | Enabled |

| Screen Reader | : | Supported |

| Enhanced typesetting | : | Enabled |

| Word Wise | : | Enabled |

| Print length | : | 91 pages |

| Lending | : | Enabled |

Covid is a time machine that dropped us all 3 to 5 years into the future. This shortened the expected life expectancy of all of our companies. My observation of this effect prompted me to write this book on how companies can survive and thrive post the crisis and maximize value at the time of an exit event-- sale, IPO or merger.

There are lots of books on exit planning, but this one adds to the process some necessary context you will find valuable as you plan your path to an exit.

- Broad economic forces have been put into play by the epidemic and governmental and societal responses to it. I write about the impact of those forces on your business.

- The disruptive forces of innovation are continuing their relentless reshaping of global economic activity. Because I was a Venture Capitalist for three decades, I developed a sixth sense about how the future affects the prospects for existing and new companies. My view of the future and its effect on your business are covered extensively in this book.

- War stories are provided as a useful context for your contemplation of the future of your business. They come from the dozens of companies I have been involved with over my career as a founder, financier, CEO, coach, or board of director’s member.

Don’t leave money on the table by waiting until you can see the exit door before beginning to prepare for it. It takes time, often years, to position your company for a value maximized sale, merger or IPO. This book guides you through the process of determining what you need to do to maximize the value of your company at the exit, which exit paths are most open to you, and what to expect from the exit process. I make the case that planning for your exit is more important now than ever. Besides the time jump mentioned above there are other forces affecting the future of your company. First, change in all aspects of our personal and business lives continues to accelerate at an ever-increasing rate, compressing the life cycle of all companies. Second, accelerating innovation is creating product and service competition for or outright disruption of your company at an increasing rate from competitors all over the shrinking globe. Third, the longer you wait for an exit the less of the total wealth that you achieve from an exit will go into your pocket. Massive government debt and the need to spend trillions of dollars on things like infrastructure and climate change mitigation will inevitably cause tax increases, and the capital gains tax rate is at the top of the list of likely large rate increases.

I hope this book helps you navigate to the exit outcome you desire. I wrote this book to share with you what I have experienced first-hand over a dozen times as a Venture Capitalist, entrepreneur, turnaround CEO and CEO coach. Add to that the experience I have gained as a board of directors’ member, often the Chairman of the Board, in over two dozen companies where I played a key contributing role in helping management teams get to the exit end zone. I believe you will benefit from reading this book. Feel free to let me know your thoughts about it. You can reach me through my website: www.johnmgrillos.com.

Reed Mitchell

Reed MitchellTango For Chromatic Harmonica Dave Brown: Unleashing the...

The hauntingly beautiful sound of the...

Patrick Rothfuss

Patrick RothfussHow To Tie The 20 Knots You Need To Know

Knot-tying is an essential...

Vince Hayes

Vince HayesThe Politics Experiences and Legacies of War in the US,...

War has always had a profound impact...

Leo Mitchell

Leo MitchellThe Psychedelic History Of Mormonism Magic And Drugs

Throughout history, the connections between...

Michael Simmons

Michael SimmonsThe Practical Japan Travel Guide: All You Need To Know...

Japan, known for its unique...

Deion Simmons

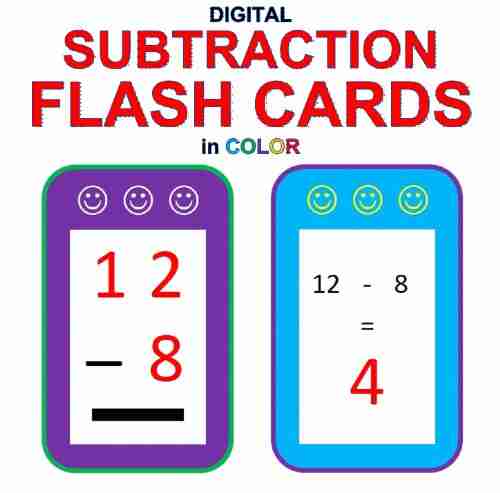

Deion SimmonsDigital Subtraction Flash Cards in Color: Shuffled Twice...

Mathematics is an essential...

Emanuel Bell

Emanuel BellUnveiling the Enigma: Explore the Fascinating World of...

Hello, dear readers! Today, we have a...

Darren Nelson

Darren NelsonHow To Handle Your Parents - A Comprehensive Guide

Are you having trouble dealing with your...

Jimmy Butler

Jimmy ButlerThe Loopy Coop Hens Letting Go: A Tale of Friendship and...

Once upon a time, in a peaceful...

Charles Dickens

Charles DickensGreen Are My Mountains: An Autobiography That Will Leave...

Are you ready to embark on an...

Drew Bell

Drew BellRogue Trainer Secrets To Transforming The Body...

In this fast-paced...

Light bulbAdvertise smarter! Our strategic ad space ensures maximum exposure. Reserve your spot today!

Dalton FosterThe Complete Guide From Start To Finish On How To Buy a Used Car From The...

Dalton FosterThe Complete Guide From Start To Finish On How To Buy a Used Car From The...

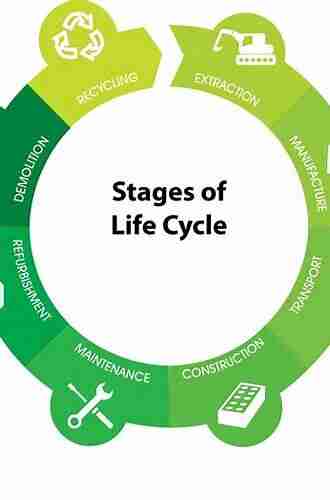

Elton HayesThe Ultimate Guide: An Environmental Life Cycle Approach To Design That Will...

Elton HayesThe Ultimate Guide: An Environmental Life Cycle Approach To Design That Will... Garrett BellFollow ·4.6k

Garrett BellFollow ·4.6k Nathaniel PowellFollow ·12.7k

Nathaniel PowellFollow ·12.7k Alfred RossFollow ·8.1k

Alfred RossFollow ·8.1k Jorge AmadoFollow ·13.6k

Jorge AmadoFollow ·13.6k Ronald SimmonsFollow ·18k

Ronald SimmonsFollow ·18k Vladimir NabokovFollow ·2k

Vladimir NabokovFollow ·2k John GrishamFollow ·11.6k

John GrishamFollow ·11.6k Ethan MitchellFollow ·13.2k

Ethan MitchellFollow ·13.2k