Do you want to contribute by writing guest posts on this blog?

Please contact us and send us a resume of previous articles that you have written.

4300 Venture Capitalist and Private Investors: Unlocking Opportunities for Entrepreneurs

In today's competitive business landscape, securing funding is often the key to success for entrepreneurs. Whether you're launching a startup or looking to expand an existing business, finding the right investors can be a game-changer. With over 4300 venture capitalists and private investors actively searching for lucrative opportunities, entrepreneurs have an incredible array of options to explore.

The Importance of Venture Capital and Private Investors

Venture capital and private investors play a pivotal role in the entrepreneurial ecosystem. These individuals and firms provide the necessary capital, expertise, and valuable connections to take businesses to the next level. Unlike traditional bank loans, venture capital and private investment often offer flexible terms and are willing to take calculated risks on innovative ideas.

Obtaining venture capital or private investment not only provides the necessary funds but also validates the potential of the business. When reputable venture capitalists or private investors commit to backing a company, it can attract further interest from other investors, partners, and customers.

4.8 out of 5

| Language | : | English |

| File size | : | 1820 KB |

| Text-to-Speech | : | Enabled |

| Screen Reader | : | Supported |

| Enhanced typesetting | : | Enabled |

| Print length | : | 47 pages |

Exploring the World of Venture Capital

The world of venture capital is diverse and dynamic. Venture capitalists are typically institutional investors or investment firms that manage funds on behalf of their limited partners. These limited partners can be anything from pension funds to universities, enabling diversification of investment portfolios.

Venture capitalists often focus on specific sectors or industries they have expertise in, such as technology, healthcare, or renewable energy. This specialization allows them to understand the nuances of the market and provide valuable guidance to entrepreneurs.

Private Investors: A Different Approach

Private investors, on the other hand, are wealthy individuals who invest their personal funds directly into businesses. Also known as angel investors, they often bring not only capital but also industry experience and contacts. Entrepreneurs seeking private investment can benefit from the personalized attention and strategic advice these individuals provide.

How to Attract Venture Capitalist and Private Investors

While venture capitalists and private investors are actively seeking opportunities, standing out from the crowd is crucial. Here are some tips to increase your chances of attracting their attention:

1. Thoroughly Research Potential Investors

Before approaching any venture capitalist or private investor, it is essential to research their investment criteria and past investments. Knowing their focus areas, preferred stage of investment, and success stories will enable you to tailor your pitch accordingly.

2. Craft a Compelling Business Plan

Your business plan should clearly articulate your vision, market opportunity, competitive advantage, and growth potential. Highlighting how the investment will be utilized and the potential returns on investment will demonstrate your understanding of the investor's perspective.

3. Build a Strong Network

Networking is invaluable when it comes to attracting venture capitalists and private investors. Attend conferences, industry events, and reach out to individuals in your industry who have successfully secured similar investments. Their insights and connections can prove instrumental in opening doors to potential investors.

4. Showcase Your Talented Team

Venture capitalists and private investors not only invest in ideas but also in the people behind them. Highlight your experienced team members, their expertise, and past successes to instill confidence in potential investors. Demonstrate that you have the right people to execute your vision.

5. Leverage Online Platforms

The internet has revolutionized the way entrepreneurs connect with investors. Utilize online platforms specifically designed to match startups with venture capitalists or private investors. Platforms like AngelList, Gust, and Crunchbase can help you expand your reach and connect with relevant investment partners.

The Future of Venture Capital and Private Investment

As the entrepreneurial ecosystem continues to evolve, so does the world of venture capital and private investment. With the rise of impact investing and the increasing emphasis on supporting diverse founders, opportunities are expanding for entrepreneurs from all backgrounds.

Furthermore, the convergence of technology and finance has enabled innovative funding models like crowdfunding and peer-to-peer lending. These alternative avenues provide additional channels for entrepreneurs to secure the necessary capital.

, venture capitalists and private investors empower entrepreneurs by offering crucial funding, expertise, and connections. As the landscape continues to evolve, entrepreneurs must stay informed, adapt their strategies, and leverage the abundant opportunities available. By taking advantage of the 4300 venture capitalists and private investors actively seeking opportunities, entrepreneurs can confidently pursue their dreams and unlock extraordinary success.

Remember, success often starts with the right investors by your side!

4.8 out of 5

| Language | : | English |

| File size | : | 1820 KB |

| Text-to-Speech | : | Enabled |

| Screen Reader | : | Supported |

| Enhanced typesetting | : | Enabled |

| Print length | : | 47 pages |

SDeC Global Venture Capital Directory

International Edition 2018 -2019

No. 34, 2018- established since 1992

Investors and Investment Companies.

4300 Venture Capitalist and Private Investors

4300 Start-up Venture Capitalist and Private Investors

Need help?

Investors and Investment Companies

We provide online assistance if you purchased the full paid version.

We can submit your documentary to our personal known investors; can check your documentation, files and project. We are in business since 1992. Many service a free of charges. Some services we charge like postal services DHL etc.

Certified copies required is some countries. However we discuss all prior starting. Just contact us via our website.

* All Active Global Venture Capital Firms and Private Investors

* Comprehensive, High Confidence Data

* Intuitive Browse and Search Functionality

* Information on Both Firms and Their Portfolio

* Contacts for Thousands of Venture Professionals

Firm and private Investors Listings Contain

* Firm Website or Private Investor Direct Contact

* Primary Office Locations

* Primary Mailing Addresses

* Primary Telephone Numbers

* Primary E-mail Addresses

* Names of Firm Management

* Management Contact Info

* Firm History / Overview

* Specific Services Offered

* Specific Investment Criteria

* Target Investment Sectors

* Target Investment Stages

* Capital under Management

* Portfolio Companies

* Date Stamp

Updated High Confidence Information

Private equity firm data and private Investor ages rapidly. Venture capital firms change focus, investment criteria, management, and even their names faster than organizations in any other sector of the financial industry. This is why updated versions of the Venture Capital Directory are published each month throughout the year. Thus, no matter when you purchase the 2016 Directory, you can be certain that the information and contacts contained within are the most up-to-date and high confidence available from any source.

However, Venture Capital firms and investors change sometimes from day to day without notice.

Industries supported by our investors:

Block chain projects

Digital Currency projects

Communication & Computer Networks

Computer Hardware

Computer Services

Consumer Products

Consumer Services

Distribution

Diversified

Education

Electronics

Enthusiast, Craft & Hobby Products

Environment

Financial Services

Internet

IT Services

Media & Entertainment

Semiconductors

Software

Technology

Telecommunication

Stages supported by our investors:

Consolidation

Early Stage

Expansion

Later Stage

Leveraged Buyout

Management Buyout

Mezzanine

Recapitalization

Restructuring

Seed

Series A

Series B

Startup

Reed Mitchell

Reed MitchellTango For Chromatic Harmonica Dave Brown: Unleashing the...

The hauntingly beautiful sound of the...

Patrick Rothfuss

Patrick RothfussHow To Tie The 20 Knots You Need To Know

Knot-tying is an essential...

Vince Hayes

Vince HayesThe Politics Experiences and Legacies of War in the US,...

War has always had a profound impact...

Leo Mitchell

Leo MitchellThe Psychedelic History Of Mormonism Magic And Drugs

Throughout history, the connections between...

Michael Simmons

Michael SimmonsThe Practical Japan Travel Guide: All You Need To Know...

Japan, known for its unique...

Deion Simmons

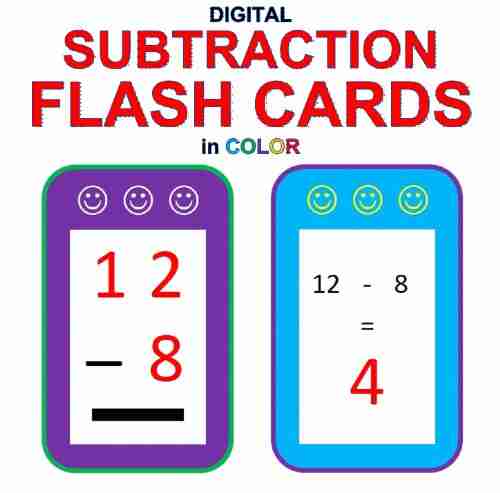

Deion SimmonsDigital Subtraction Flash Cards in Color: Shuffled Twice...

Mathematics is an essential...

Emanuel Bell

Emanuel BellUnveiling the Enigma: Explore the Fascinating World of...

Hello, dear readers! Today, we have a...

Darren Nelson

Darren NelsonHow To Handle Your Parents - A Comprehensive Guide

Are you having trouble dealing with your...

Jimmy Butler

Jimmy ButlerThe Loopy Coop Hens Letting Go: A Tale of Friendship and...

Once upon a time, in a peaceful...

Charles Dickens

Charles DickensGreen Are My Mountains: An Autobiography That Will Leave...

Are you ready to embark on an...

Drew Bell

Drew BellRogue Trainer Secrets To Transforming The Body...

In this fast-paced...

Light bulbAdvertise smarter! Our strategic ad space ensures maximum exposure. Reserve your spot today!

Milan KunderaPreserving The Recent Past As Landscape And Place: The Key to Our Cultural...

Milan KunderaPreserving The Recent Past As Landscape And Place: The Key to Our Cultural...

Cooper BellThe Enchanting Legacy: The Life And Work Of Lucia Dlugoszewski in California...

Cooper BellThe Enchanting Legacy: The Life And Work Of Lucia Dlugoszewski in California... Neil GaimanFollow ·10.4k

Neil GaimanFollow ·10.4k Leon FosterFollow ·10.5k

Leon FosterFollow ·10.5k D'Angelo CarterFollow ·19.2k

D'Angelo CarterFollow ·19.2k Ralph Waldo EmersonFollow ·10.9k

Ralph Waldo EmersonFollow ·10.9k Ian MitchellFollow ·4.6k

Ian MitchellFollow ·4.6k Efrain PowellFollow ·9.3k

Efrain PowellFollow ·9.3k Curtis StewartFollow ·6.1k

Curtis StewartFollow ·6.1k Frank MitchellFollow ·18.6k

Frank MitchellFollow ·18.6k