Do you want to contribute by writing guest posts on this blog?

Please contact us and send us a resume of previous articles that you have written.

Things Every Dividend Investor Should Know

Investing in dividends can be a lucrative strategy for many investors. Dividends provide a stable stream of income, allowing investors to potentially enjoy regular cash flows from their investments. However, to maximize the benefits of dividend investing, it is crucial to understand certain key concepts and strategies. In this article, we will explore the things every dividend investor should know to make informed decisions and achieve long-term success in the market.

Understanding Dividends

Dividends are payments made by companies to their shareholders out of the profits they generate. These payments are typically distributed on a regular basis, such as quarterly or annually, and are considered a portion of the company's earnings. Dividends can be an attractive feature for investors, especially those seeking a steady income stream from their investments.

When investing in dividends, it is important to consider the dividend yield. The dividend yield is calculated by dividing the annual dividend payment by the stock price. It indicates the percentage of return an investor can expect from dividends alone. A higher dividend yield can be advantageous, but it is crucial to analyze other factors, such as the company's financial health and dividend growth history, to ensure sustainability.

4.6 out of 5

| Language | : | English |

| File size | : | 386 KB |

| Text-to-Speech | : | Enabled |

| Screen Reader | : | Supported |

| Enhanced typesetting | : | Enabled |

| Word Wise | : | Enabled |

| Print length | : | 96 pages |

| Lending | : | Enabled |

The Power of Dividend Growth

Dividend growth is a key aspect of dividend investing. Companies that consistently increase their dividend payments over time can provide significant long-term benefits to investors. Dividend growth not only boosts the income generated from investments but also indicates the company's financial strength and stability.

To identify companies with sustainable dividend growth, investors should focus on metrics such as the dividend payout ratio and free cash flow. The dividend payout ratio measures the percentage of a company's earnings paid out as dividends. It is important to ensure that the payout ratio is reasonable and leaves room for future dividend increases. Free cash flow, on the other hand, shows the company's ability to generate cash after covering operating expenses, capital investments, and debt obligations.

Diversification and Risk Management

Diversification is a crucial strategy for dividend investors. By spreading investments across different sectors, industries, and geographical regions, investors can reduce the risk associated with individual companies and market fluctuations. Diversification allows investors to benefit from the dividend income of multiple companies while minimizing the potential impact of any single company's dividend cut or suspension.

Additionally, dividend investors should pay attention to the fundamental analysis of potential investments. This involves evaluating the company's financial statements, competitive position, industry trends, and management capabilities. Conducting thorough research and analysis can help identify companies with sustainable dividend policies and solid growth prospects.

Reinvesting Dividends

Reinvesting dividends can significantly boost long-term returns for dividend investors. By reinvesting the received dividend payments back into additional shares of the same company or other dividend-paying stocks, investors can take advantage of compounding growth. Over time, the reinvested dividends can generate an exponential increase in wealth, creating a powerful wealth-building strategy.

Many brokerage firms offer dividend reinvestment plans (DRIPs),allowing investors to automatically reinvest dividends without incurring additional fees. By participating in a DRIP, investors can accumulate more shares over time, ultimately leading to higher dividend payments in the future.

Monitoring and Adaptation

Lastly, dividend investors should continuously monitor their investments and adapt to changing market conditions. This involves staying updated on the performance of invested companies, as well as industry and economic trends. Regular review of dividend growth, financial statements, and news about the company can help investors identify potential risks or opportunities.

In times of market turbulence or when a company faces financial difficulties, dividend investors may need to make adjustments to their portfolios. It is important to remain flexible and consider selling stocks experiencing dividend cuts or suspensions. By reallocating funds to companies with better dividend prospects, investors can protect their income stream and maintain long-term growth potential.

Dividend investing can be a rewarding strategy for investors seeking regular income and long-term growth. Understanding key concepts such as dividend yield, dividend growth, diversification, reinvestment, and monitoring is essential for dividend investors. By applying these principles and conducting thorough research, investors can make informed decisions, mitigate risks, and build a successful dividend portfolio. So, whether you are a seasoned investor or just starting in the world of Dividend Investing, remember these crucial things every dividend investor should know.

4.6 out of 5

| Language | : | English |

| File size | : | 386 KB |

| Text-to-Speech | : | Enabled |

| Screen Reader | : | Supported |

| Enhanced typesetting | : | Enabled |

| Word Wise | : | Enabled |

| Print length | : | 96 pages |

| Lending | : | Enabled |

Passive income has become a big topic nowadays. As people become busier and stressed, they are trying to search for alternate sources of income. Something they can earn passively. Making a living off dividends is one of the best ways to take part in investing and growing your wealth. Be warned this is not a get-rich easy scheme.

Living off dividends passive income strategy requires you to put a lot of time and effort over the long term to be successful. Many beginning investors do not understand what a dividend is — as it relates to an investment—particularly for an individual stock or mutual fund.

With that being said, the author reveals to you the nuts and bolts of dividend investing for beginners. You will discover how dividends work and what to look out for when picking stocks. While this book provides you the most effective and time-tested investment strategies using dividends, it will conclude with a secret list of high-yield titles for 2020 to get you started right off the bat (a list that financial advisors and banks don’t want you to know).

In this book you will discover:

-The key concepts of dividend investing and what to look for when picking your titles

-The hidden power of dividend investing many books fail to inform about

-7 Proven investment strategies that have been proven time and again to be effective

-A simple technique to never buy your assets at their highest prices

-Discover the key steps to profitable investing – especially for beginners

-How to win the investment game using mutual funds and exchange-traded funds (ETFs)

-5 top picks for dividend-paying ETFs

-Startling ways to invest in dividends while saving on taxes big time

-3 Unconventional dividend investments with “unconventional” gain-potentials

-4 high paying Real Estate Investment Trusts (REITs) you want to draw your attention to

-A foolproof way to generate solid annual returns through indirect bond investing

-Bonus chapter: Top ten high potential dividend stock to consider for 2020

And much, much more.

Reed Mitchell

Reed MitchellTango For Chromatic Harmonica Dave Brown: Unleashing the...

The hauntingly beautiful sound of the...

Patrick Rothfuss

Patrick RothfussHow To Tie The 20 Knots You Need To Know

Knot-tying is an essential...

Vince Hayes

Vince HayesThe Politics Experiences and Legacies of War in the US,...

War has always had a profound impact...

Leo Mitchell

Leo MitchellThe Psychedelic History Of Mormonism Magic And Drugs

Throughout history, the connections between...

Michael Simmons

Michael SimmonsThe Practical Japan Travel Guide: All You Need To Know...

Japan, known for its unique...

Deion Simmons

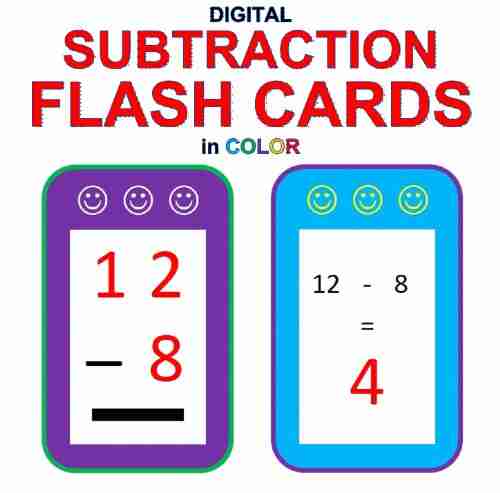

Deion SimmonsDigital Subtraction Flash Cards in Color: Shuffled Twice...

Mathematics is an essential...

Emanuel Bell

Emanuel BellUnveiling the Enigma: Explore the Fascinating World of...

Hello, dear readers! Today, we have a...

Darren Nelson

Darren NelsonHow To Handle Your Parents - A Comprehensive Guide

Are you having trouble dealing with your...

Jimmy Butler

Jimmy ButlerThe Loopy Coop Hens Letting Go: A Tale of Friendship and...

Once upon a time, in a peaceful...

Charles Dickens

Charles DickensGreen Are My Mountains: An Autobiography That Will Leave...

Are you ready to embark on an...

Drew Bell

Drew BellRogue Trainer Secrets To Transforming The Body...

In this fast-paced...

Light bulbAdvertise smarter! Our strategic ad space ensures maximum exposure. Reserve your spot today!

Earl WilliamsUnveiling the Remarkable Leadership of Harriet Tubman during the Civil War...

Earl WilliamsUnveiling the Remarkable Leadership of Harriet Tubman during the Civil War...

August HayesThe Old Brown Suitcase: A Remarkable Tale of Resilience and Hope by Lillian...

August HayesThe Old Brown Suitcase: A Remarkable Tale of Resilience and Hope by Lillian... Curtis StewartFollow ·6.1k

Curtis StewartFollow ·6.1k Clarence BrooksFollow ·18.7k

Clarence BrooksFollow ·18.7k Jerry WardFollow ·14.9k

Jerry WardFollow ·14.9k Max TurnerFollow ·8.9k

Max TurnerFollow ·8.9k Devin RossFollow ·15k

Devin RossFollow ·15k Roald DahlFollow ·4.7k

Roald DahlFollow ·4.7k Deion SimmonsFollow ·19k

Deion SimmonsFollow ·19k Leslie CarterFollow ·3.2k

Leslie CarterFollow ·3.2k